Nelson continues to be one of the most innovative communities in BC

It’s property tax time.

And now most property owners throughout the City will have recently received their property tax notices for 2018.

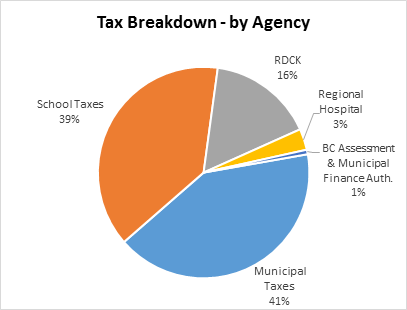

In a media release Wednesday, Nelson City Council and staff said they have been working over the past six months putting together the financial plan which identifies the revenues, expenditures and contributions to reserves that ultimately result in the amount of taxes and other fees that the City needs to collect in order to provide the services that we as citizens utilize every day.

The media release said Nelson continues to be one of the most progressive and innovative communities when it comes to managing costs and generating non-tax revenues to fund city services.

“The 2018 budget makes it possible for the City of Nelson to continue to deliver the high level of service our residents expect. Council and staff work hard to balance current needs with future planning,” Nelson Mayor Deb Kozak said in the release.

“These plans have been carefully managed within modest increases. Council has been successful in keeping tax increases closely in-line with inflation rates, as we continue to manage operating costs and contribute to capital reserves. New this year are higher investments in streets, roads and facilities as we further refine our asset management strategy.”

The release said that Nelson has a long history of being progressive, starting at the time of incorporation, back in 1897, when the City purchased its first power plant at Cottonwood Creek.

In 1907, the City’s forefathers went out on a limb, again, and built the Bonnington Falls power plant. Today, as owners of the electric utility (Nelson Hydro), the City, like other regulated utilities, receives an annual return on these assets.

In 2018, the return on its investment will be almost $2,800,000.

“These revenues are used to fund the general operations of the City,” the release said. “Without these revenues, municipal taxes would have to rise 32% or services significantly reduced. In addition to this, in 1989, City Council negotiated an agreement with BC Hydro to be compensated for lost water rights on the Kootenay River. This is called the Water License Agreement and under this agreement the City gets credit for additional power generation which adds up to $650,000 per year.

“This (revenue) funds capital purchases in all departments of the City, with the largest expenditures being information technology and parks.”

The release said the city also generates revenue by providing financial services for the communities of Silverton, Slocan and Salmo, electrical engineering services for Grand Forks and fire services for the Blewett area of the Regional District.

“These contracts alone generate revenues of over $250,000 annually for the City,” the release said, adding the City also created its own high-speed fibre business which is generating close to $110,000 per year.

The release said the Nelson Police Board also generates significant non-taxation revenues including acting as the remand centre for the region ($200,000 per year), seconding officers to the RCMP road safety unit ($400,000 per year), providing 911 services ($30,000 per year) and providing victim services for the RCMP ($38,000 per year).

“While some of these services come with additional cost, they all either improve services to Nelson residents and businesses, or generate a profit which reduces property taxation,” the release said. “They allow Nelson to take a leadership role and help support our rural communities. It really is a win-win situation.”

The City said it also generates significant revenues from leasing City-owned facilities.

The most significant is 310 Ward Street – City Hall, purchased 10 years ago, when Council was working with the cultural and recreation sectors to deliver much needed new facilities to the community, one of the challenges was to find a new location for the museum.

Council of the day was able to negotiate a deal with the province where the province guaranteed to rent certain space for a set number of years.

“The province pre-paid their rent which reduced the City’s purchase price to $2,000,000, which debt has now been long paid off and the building is generating a net profit of $365,000 per year,” the release said. “The City also leases out a number of its other buildings and public spaces including parts of the Civic Centre, 10th Street Campus, sidewalk café spaces, the tourist park and the airport. Total City leases and fees for City properties generates over $600,000 per year. These revenues are directed back into maintaining City facilities and the downtown.”

Another number that amazes our local government colleagues in other communities is the parking meter revenues that the City generates.

“Parking meters generate almost $1,000,000 per year and this goes directly to the road re-surfacing program,” the release said. “In 2017, Council doubled the amount going towards the re-surfacing program from $600,000 per year to $1,200,000 per year.”

The budget also allows those roads in poor condition to be resurfaced where underground utility renewal is not required for at least another 30 years.

“Prior to this increase in budget, the funding would allow for road re-surfacing work once every 60 years, which was clearly not option to be able to retain the quality of road surfaces.”

The media release said that Council has also created an annual contribution to a building reserve fund to start to tackle the significant investments it needs to maintain its aging facilities.

“The recently completed Facilities Assessment Report has identified that the City should spend almost $2,000,000 per year on its facilities. Starting in 2017, Council has increased its spending on facilities by over $1,000,000 per year. This is a four-to-five times increase in what the City was spending in prior years. This has been accomplished through recouping taxation that was going into the Nelson & District Community Complex (NDCC) and directing grants and facility leasing revenues into facility renewals.”

Finally, the City receives almost $2,000,000 per year in ongoing operating grants from senior levels of government. This is in addition to the capital grants it receives for specific capital projects such as Hall Street ($4.5M) or the Water Capital Project ($6M).

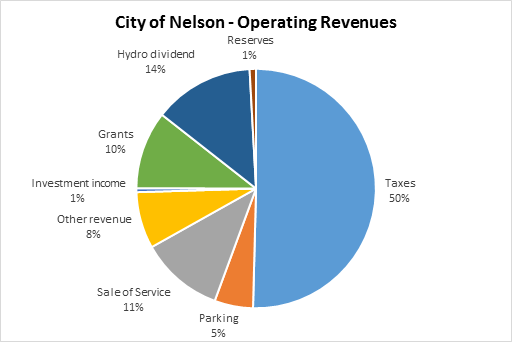

“This means that the City generates 50% ($10,000,000) of its revenues for the general operating budget from non-property tax activities. This allows Council to be able to invest in the renewal of its facilities, roads, sidewalks, parks, downtown, as well as provide a high level of service, including professional fire, its own police force, world-class parks, recreation and cultural activities. This would not be possible without generating this level of non-property tax revenues.”