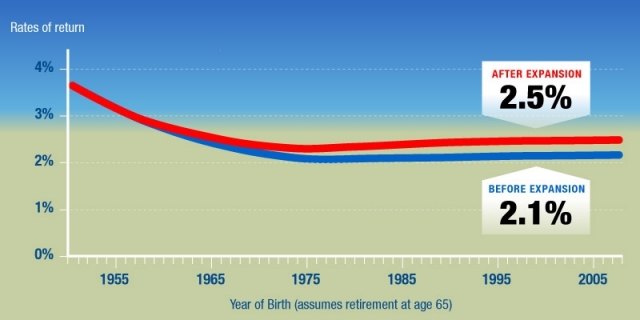

CPP expansion will do little to boost rate of return, particularly for younger Canadians

Despite an expanded Canada Pension Plan (CPP), workers in Canada — particularly younger workers—will still receive a meagre rate of return from their CPP contributions (2.5 per cent or less), finds a new analysis released today by the Fraser Institute, an independent, non-partisan Canadian public policy think-tank.

The provinces and the federal government have reached an agreement in principle on CPP expansion — a move that will increase mandatory contributions on working Canadians starting in 2019 in exchange for higher CPP retirement benefits in the future — with ratification of the agreement expected this week.

“As the provinces and Ottawa seek to ratify the CPP’s expansion, Canadians should clearly understand what they’ll receive in return for higher CPP contributions,” said Charles Lammam, director of fiscal studies at the Fraser Institute and co-author of Rate of return for expanded CPP remains meagre.

Under the proposed CPP expansion, Canadians born in 1971 or later can expect to receive a rate of return (after inflation) of up to 2.5 per cent from their CPP retirement benefits. This represents a small increase in the long-term rate of return — 2.5 per cent after CPP expansion versus 2.1 per cent before expansion.

Unfortunately, Canadians who believe the CPP offers a high rate of return often confuse the individual rate of return (again, just 2.5 per cent or less for Canadians born after 1971) with the 11.4 per cent average return earned over the past five years by the CPP’s investment arm, the Canada Pension Plan Investment Board (CPPIB).

CPPIB returns have no direct effect on benefits received by retirees.

CPP retirement benefits are determined by the number of years a person works, their annual contributions (up to a maximum of $5,089 this year, based on earnings), and the age they retire — not CPPIB rates of return.

“Even with the proposed changes to the CPP, the rate of return for individual Canadians remains meagre. Therefore, expansion of the CPP cannot be justified by claiming the plan provides a high rate of return for contributors.”