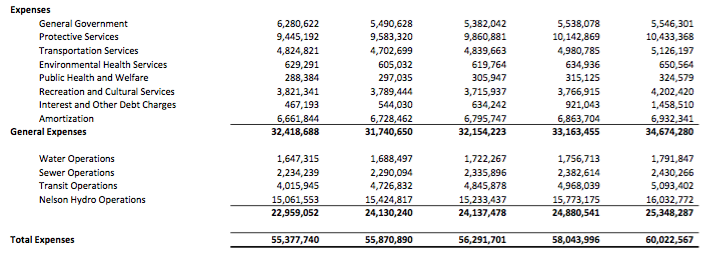

Pumped up: City tax rate rises above inflation in delivering tax take total for 2024

If you were looking to municipal government for a tax break while costs around us continue to climb, think again: the City is moving ahead with a 4.8 per cent property tax increase this year.

On April 23 during a special city council meeting in council chambers the elected officials passed third reading on the Five-Year Financial Plan Bylaw that calls for the increase — down from last year’s 5.8 per cent.

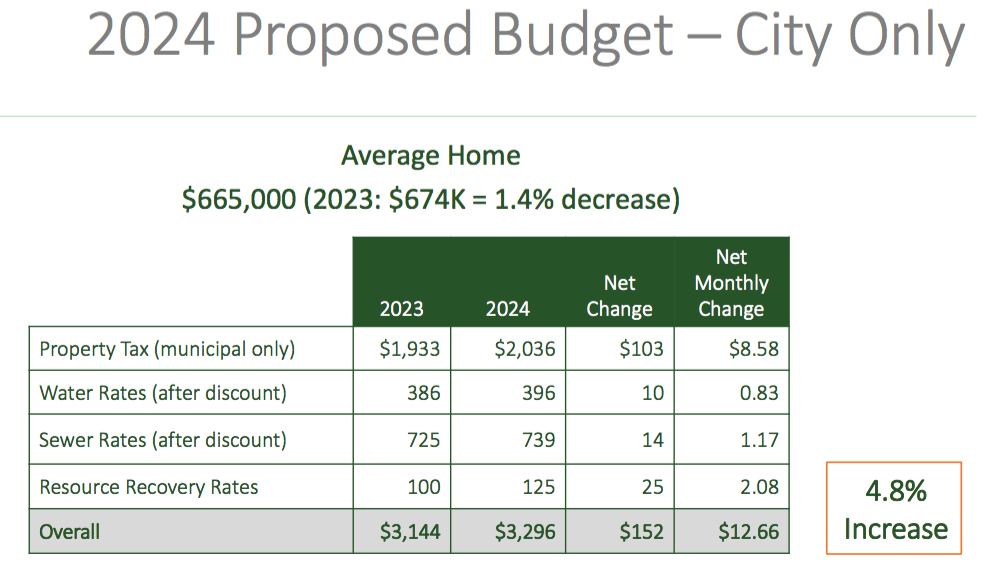

But council didn’t stop there. Add in a 2.5 per cent hike to water rates, another two per cent hike to the sewer utility bill and a 25 per cent jump for resource recovery, and the tax bite starts to become several mouthfuls.

Where the choking begins is the additional seven per cent that the Regional District of Central Kootenay will be asking for on the tax bill, and a yet-to-be determined chunk from School District No. 8 (Kootenay Lake) and the regional hospital authority.

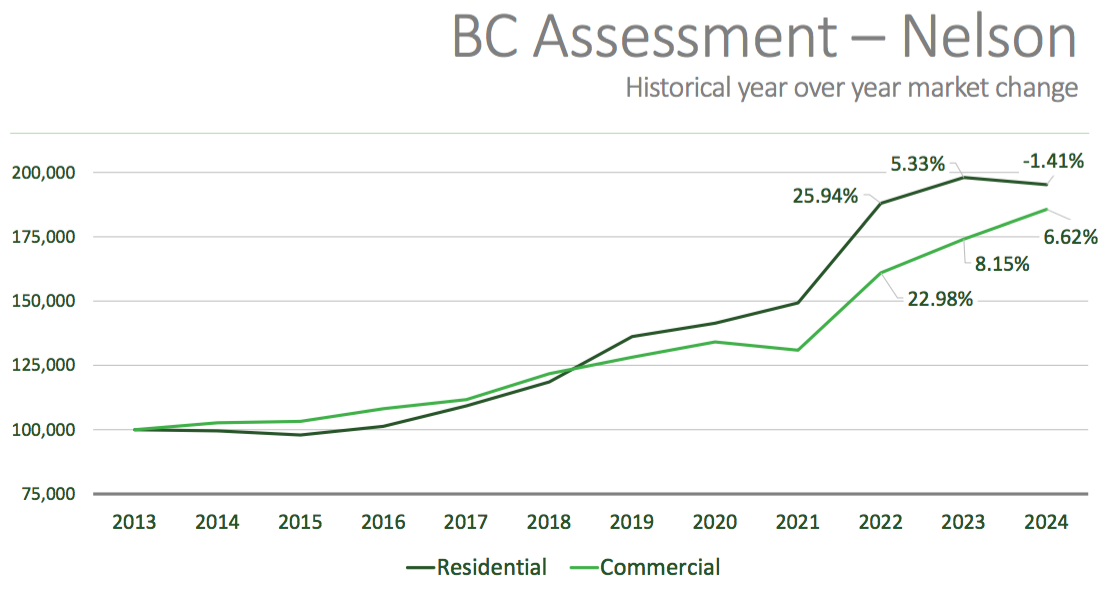

BC Assessment and Municipal Finance Authority taxes make up the remainder of the tax bill.

“All proposed expenditures, funding sources and transfers, to or between funds, must be included in the plan,” noted City chief financial officer Chris Jury in his report to council. “In considering the proposed larger tax increase this year, a key fact to keep in mind is that over the past five years council has been able to keep overall tax and fee increases below, or at, yearly inflation rates provided by Statistics Canada.”

For the average residential home in Nelson, the municipal property taxes for 2024 are estimated to be $2,036. The water and sewer and resource recovery rate increases equate to a $49 rise for a single-family home.

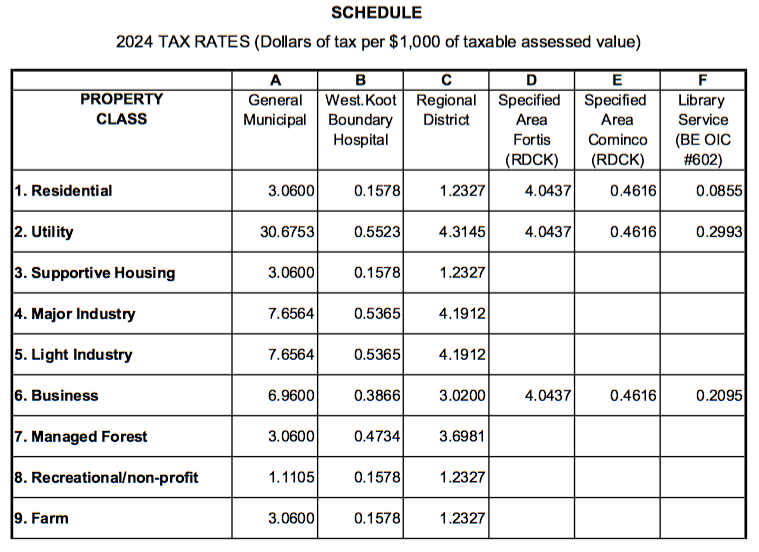

Setting tax rate

An Annual Tax Rate bylaw is also required in order to collect the appropriate funds to finance the activities laid out in the financial plan.

This year City of Nelson taxes are due at the end of the business day on July 2 — with a 10 per cent penalty on taxes paid after this date. The tax rates presented are based on the 2024-2028 Five-Year Financial Plan that was presented for first three readings on April 23.

The City takes a “fixed share approach” to tax rates between classes; where the share of the total tax levy collected from each property class remains consistent over time, subject to adjustments arising from non-market (new construction) change in the assessment role or council’s decision to adjust the share for each class.

In 2024, with the adjustments made for new construction, 74 per cent of property tax will be contributed by residential taxpayers and 26 per cent from the commercial sector.

Source: City of Nelson, April 23 agenda

Getting there

The 2024-2028 financial plan process included council and city staff having a variety of internal, external and public meetings over the past six months to review current financial performance, budgetary pressures and forecast departmental budgets.

The budget open house was held earlier this year, with the presentation being streamed online. There were members of the public present, with some non-staff and council participants.

“Council should be aware that, other than the few questions that were asked at the presentation, the Finance department did not receive any more questions or communications from the public regarding the budget or the budget presentation,” said Jury.

Source: City of Nelson, April 23 agenda