City presents proposed budget with 1.5% property tax increase

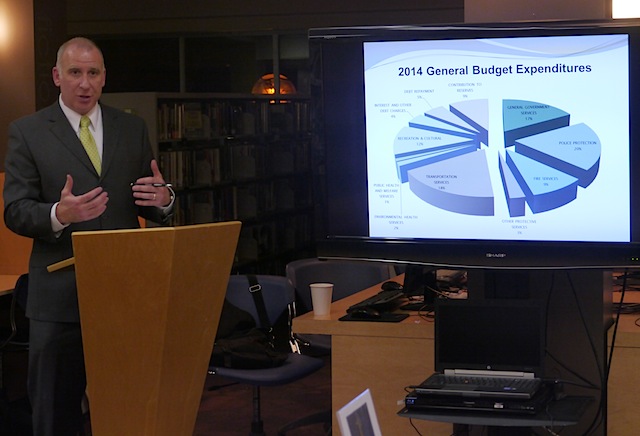

The City of Nelson wants to raise property taxes by 1.5% for 2014. That would amount to an increase of $21 per year for a $300,000 home. The increase would allow the city to provide the same services as last year, fund a few new projects, and balance its $40 million budget.

The 1.5% increase would generate an additional $105,000 for city operations.

The city’s chief financial officer Colin McClure said the city will take in about $8 million in tax revenue but will have about $16-million in operating expenses. This is a typical ratio for the city.

For 2014 that income shortfall will be made up by the property tax increase and a number of other increases in revenue including:

- New market construction tax revenue at $85,000

- A $100,000 increase in the annual Nelson Hydro shareholder dividend to the city

- A 4% or $19 increase in water rates for a home

- A 3% or $12 annual increase in sewer rates for a home

- A 1.97% annual increase in hydro rates

Increases in sewer and water rates are part of the city’s multi-year plan to upgrade water and sewer infrastructure, i.e. replace old pipes in the ground.

McClure explained that Nelson is the only municipality in Canada that generates its own electricity, and without the resulting $14.8-million Nelson Hydro dividend the city would have to raise taxes by 35%.

McClure explained that the city maintains statutory reserves to which it makes a contribution every year and which are used for specific purposes such as equipment replacement and capital projects.

An important capital project for the upcoming year will be the Hall Street Corridor, which McClure named as one of council’s priorities. This year the city intends to finishing planning for, and begin construction of, the three blocks of the project from IODE Park north to the intersection of Hall and Lake Streets, at a cost of $1.4-million.

McClure said that when homeowners get their tax bill, the increase will be larger than the city’s 1.5% because the city collects taxes for the Regional District of Central Kootenay, the hospital, and the school district and all of those are lumped together in the tax notice.

Wages and benefits for the city’s 165 employees account for about 75% of the city’s expenditures. The budget plan is subject to the uncertainty of three new collective agreements still to be negotiated with police, fire, and electrical workers, all of whose contracts with the city have expired.

Council will make its final decision on the proposed 2014 budget with their first three readings of the budget bylaw at its regular meeting on April 8.