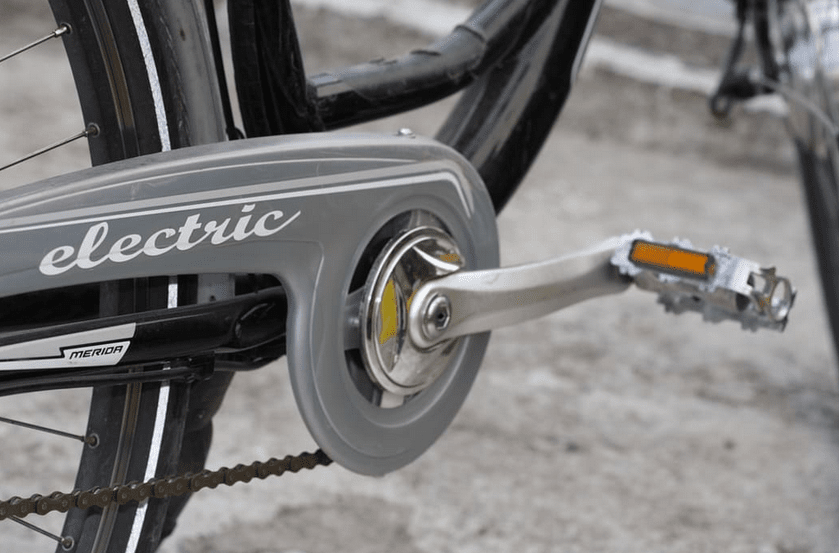

E-Bike program gets A-grade as demand increases for the green technology

The rise in popularity of the City’s E-Bike program has fueled a move to expand the financial loan service offered through the municipality.

The City’s EcoSave Retrofits Program Bylaw is being amended to provide a greater amount of loans to Nelson Hydro’s city customers — increasing from $500,000 in total to $1 million — after the aggregate of loans reached the first mark.

The EcoSave Retrofits Program provides loans to Nelson Hydro for people to fund energy retrofit projects and E-Bike purchases, repaying through Nelson Hydro’s on-bill financing. The bylaw had set a cap for the aggregate of such loans issued by the City at an amount of $500,000 — an amount that has been reached.

Obviously, it is a successful program and it is measured in the amount of uptake, said Mayor Janice Morrison when the bylaw was read for the first three times in council chambers June 6.

“(But) has everybody been paying us back? Have we had any defaults or any concerns about people not being able to pay back their loans?” she asked.

City chief financial officer Chris Jury said there were no defaults or losses on the loans, mentioning that the city had the bill collection tools of Nelson Hydro to recover funds if people were remiss in paying the loan.

“If there were balances that were unpaid (we) would have the ability to go onto collections,” he said.

The City first began offering on-bill financing for energy retrofit programs in 2012 when it adopted the EcoSave Retrofits Program Bylaw, said Climate and Energy manager Carmen Procter.

Bill me later

On-bill financing refers to the financial loan service that the City of Nelson has made available for energy retrofits and E-Bike purchases to Nelson Hydro’s city customers.

The customer repays the on-bill financing loan on their regular Nelson Hydro utility bill through automatic withdrawal.

The loan is available to those who reside within the City of Nelson and own a home and approval is based on payment history and property ownership verification.

The maximum allowable loan for retrofits is $16,000 with the choice of a five- or 10-year repayment term. The maximum allowable loan for an E-Bike purchase is $8,000 with the choice of a two- or five-year repayment term. The current fixed interest rate is 3.5 per cent and is subject to change for any new loans on January first of each year.

Source: City of Nelson June 6 agenda

Three years ago the E-Bike offering was added and, as E-Bikes technology has improved, they are rapidly becoming more popular amongst city residents, said Procter in her report to council.

Bikes generally being bought by those aged 31-50 years old, with the average loan for an E-Bike hovering around the $4,700 mark. About 60 per cent favour the five-year option for the E-Bike, as opposed to the two years offered.

She said 112 people in last 12 months — June of 2022 to June of 2023 — have applied for the E-Bike program, but 139 loans have been administered.

“What we saw in the first couple of years is people applied and it took a little while to get the bike they wanted and it was on back order,” she said. “I feel like now, when people are applying for their loan they are handing it in a lot sooner because it seems more bikes are available.”

More “robust” communications and marketing around the programs have led to increased awareness and uptake for the City program, she added.

As a result, the program should continue to see significant demand.

However, since the program’s inception, Procter said there has been a zero loss rate from loans with the vast majority of loans being repaid in a timely manner.