New heights set for city taxes as inflation continues to cause the climb

General inflationary increase is the line item underlining every aspect of the City’s budget for 2023, giving credence to a 5.8 per cent increase in property taxes Nelsonites much shoulder for the coming year.

In its budget open house meeting on March 30 in city council chambers, the City’s Financial department unveiled the nearly-minted final version of the budget, with departmental break downs and some insight into the financial paths homeowners’ tax dollars take.

Chief financial officer Chris Jury told city council the budget tried to rein in the rising cost of everything the City has to purchase — at an inflation rate of 5.25 per cent in February — while still being able to continue to provide the same services to Nelsonites.

“(T)he growth of inflation has slowed but we are still seeing increases and, of course, that is something we are catching up a bit from 2022 and trying to contain these costs in our 2023 budget,” he said.

The total city budget is roughly $23 million.

After B.C. Assessment had its say on the city’s real estate market, the percentage change in Nelson for residential homeowners was 5.33 per cent and 8.15 for commercial in 2023 — the provincial average increase for 2023 was 12 per cent. That followed a record 25.94 per cent increase in residential in 2022, coupled with a 22.98-increase for commercial that same year.

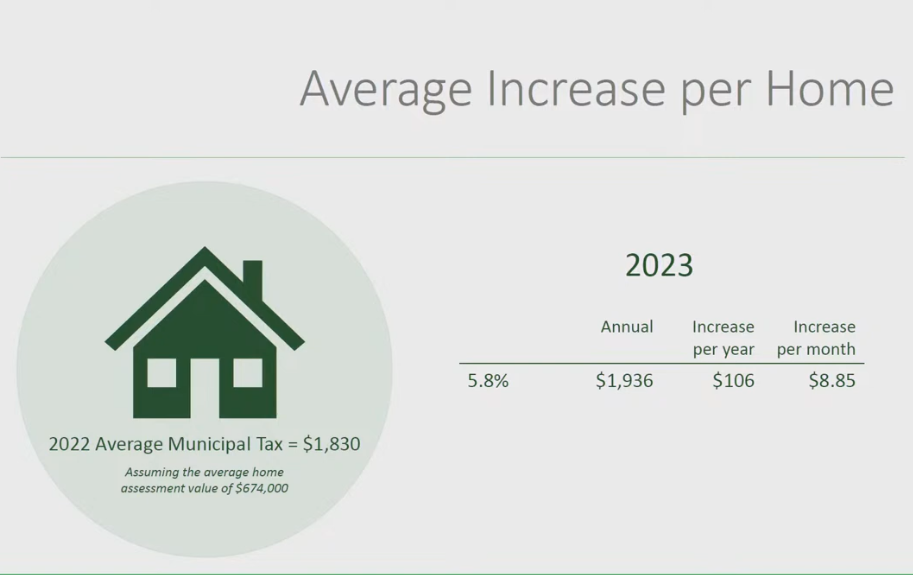

In the last 10 years assessments have doubled in Nelson, said Jury, meaning that $337,000 average home in 2013 has reached $674,000 in 2023.

Taking that average home assessment value of $674,000, and translating a 5.8 per cent assessment increase means in 2023 an average tax of $1,936 for homeowners in Nelson, an increase of $106 for the year, or $8.85 more per month. In 2022 the average municipal tax was $1,830.

The budget was put together for a 5.8 per cent property tax increase, but it also includes some other internal cost pressures, said Jury. Although property taxes increase (municipal only) by $106, water rates are rising by $7 per year, sewer rates jump by $15 and resource recovery rates (zero increase) to a total net change of $128 — a total of $3,147 on the municipal bill — which is a 4.2 per cent increase from last year.

“If you look at a lot of the services the city provides … we have really endeavoured to keep that overall tax increase to the tune of inflation, or below levels,” Jury pointed out.

In 2019 the City instituted a 1.9 per cent tax increase (inflation of 1.9) followed by a 2020 1.8 per cent increase (.7 inflation), with 2021 a 1.6 per cent increase from the city (inflation was 3.4 per cent) and a 2022 increase from the city of 3.9 per cent (6.8 per cent inflation). In 2023 the city’s 4.2 per cent increase is behind the rate of inflation of 5.2 per cent.

For commercial, it is a 4.6 per cent increase, representing a $451 increase on an average $1 million assessed property, resulting in $387 more in property taxes.

By department

The department that consumes the most revenue resources is the city’s Protective Services, which see a six per cent increase in its budget this year. The department is back to full strength which means lowered overtime costs, but it will still require $8,628,165 to operate.

Included in that figure is the city’s fire and emergency departments, which will see the addition of a new executive assistant position to assist with grant applications and an increase in training costs (on hold during the pandemic).

The general government budget will rise by two per cent to $4,989,011 while Engineering and Public Works is down by four per cent to $4,198,950 — the only city department showing a decrease. The drop comes from a decrease in the snow removal budget with a focus on handling capital projects in-house.

Waste and Organics budget is up by 17 per cent to $583,974 due to general inflationary increases and an increased tipping fee of 10 per cent levied by the Regional District of Central Kootenay (RDCK) at the Grohman Narrows transfer station.

Parks, Recreation and Cultural Services is going up by four per cent to $2,494,159, with the budget seeing an increase in youth centre participation and programs, an increase in COVID recovery grants and general inflationary increases.

Nelson Library budget is up by four per cent ($644,787) due to general inflationary increases and to offset the removal of library fines.

“So if you are doing some spring cleaning and you find some old library books you are more than welcome to bring them in and trade them for some new ones at no cost,” deputy financial officer Amy said.

Funding sources

To find out how the city pays for the services it offers you need to follow the money.

The money for the city’s budget comes mostly from property taxes at 50 per cent, followed by sale of services — like parking meters — (18 per cent) with “other revenue from own sources” at 15 per cent.

The city also gets some revenue from conditional grants (11 per cent) and two per cent from unconditional grants. Grants-in-lieu of taxes make up three per cent. Interest income is one per cent of the budget

Police comprises the biggest player of the budget at 20 per cent, followed by general government at 18 per cent and Engineering and Public Works at 16 per cent.

Allocations to reserves (13 per cent), fire and emergency management (10 per cent), Parks, Recreation and Cultural Services (nine per cent) and transit (seven per cent) are also some of the bigger budget players.

When the tax notice is delivered later this spring, Jury stated that only $48 out of every $100 on the tax bill is collected as city taxes, there are also school taxes ($28), RDCK ($20), regional hospital ($3) and BCAA and MFA ($1) on there as well.

“So, while the city increase might be 5.8 per cent, we don’t have any control over what those other entities might have for their increases,” he said.

The tax increase for Nelson from the RDCK has been announced at 7.07 per cent.