Average tax hit nudges above $4,000 as the bill comes due for Nelsonites

The taxation toll will be deep for Nelsonites when the bill comes due this spring.

In addition to the property taxes the corporation of the City of Nelson levees, there are several other taxes that will impact Nelson households as the cost of residing within city limits will be rising.

The total bill will rise to just over $4,000 per household this year, based on the city’s planned property tax, water and sewer increases, and 2015 numbers ― based on a $328,814 home ― that saw individuals cough up just under $4,000.

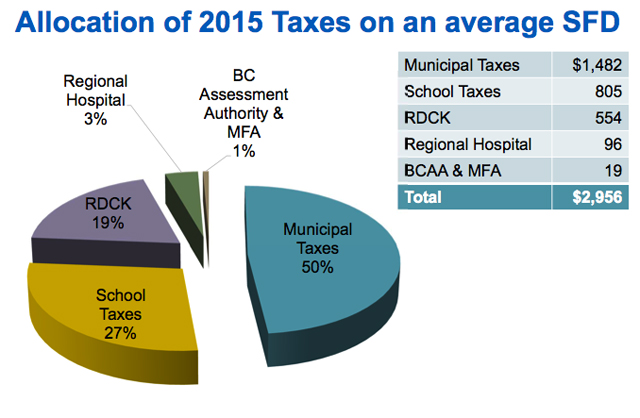

The total bill includes taxation assessed by the Regional District of Central Kootenay, the West Kootenay Regional Health Board, School District 8 (Kootenay Lake) and the Province of B.C. ― all of which the city collects for.

Of the total amount, half will go to the City of Nelson, around $1,100 to water and sewer taxes, nearly one third to school taxes, almost 20 per cent to the regional district, three per cent to the regional hospital board and one per cent to the Municipal Finance Authority and the B.C. Assessment Authority.

Property taxes assessed by the City of Nelson will rise 1.75 per cent for 2016, along with other utility increases, the city’s chief financial officer Colin McClure said.

On the regional district side of the ledger, general administration service will decrease by about 10 per cent compared to last year, while rural administration will rise around five per cent. Other changes include increases to the building inspection (7.8 per cent) and planning (15 per cent) services.

“There are some increases related to service demands; however, we hope that decreases in other services will result in a small impact on individual tax bills,” said Stuart Horn, chief administrative officer for the RDCK.

Total taxation for the district is approximately $25 million.

In addition to the municipal property tax increase ($26 annual increase, based on a $328,814 home), city council has formulated a three per cent increase ($15 annual increase) in water rates per home, as well as two per cent ($10 annual increase) in sanitary sewer rates for a home.

There will also be a 3.8 per cent increase in Nelson Hydro rates effective April 1 (a 2.6 per cent annual increase). There will be no change in garbage and recycling fees since the city is currently receiving $140,000 annually from Multi-Material B.C. to collect recycling, enough to fund the operation.

Not including the power rate increase, the city’s residential taxpayers will pay an average increase of $51 to the city ― rising from $2,557 (2015 actual) to $2,608 (2016 proposed).

Businesses in the city ― which make up 25 per cent of the tax role ― will see an average increase of $236 per year. Based on a $1 million assessed value commercial restaurant, taxes rise from $12,169 (2015 actual) to $12,404 (2016 proposed).

The city tax increase won’t be as a result off the Nelson Police Department (NPD) budget increase, which would have bumped the increase by four per cent. The police department asked for an increase of $310,000 for 2016 ― for two new officers and an administrative staff person ― and the final decision from the provincial director of police services directed one officer and one administrative position.

Mayor Deb Kozak said the city’s 1.75 per cent increase is “in line with city council’s strategic priority to keep property tax increases at inflationary levels and as low as possible while dealing with the ever increasing operational costs of the city.”

The increase in city property taxes will cover inflationary and expected collective agreement wage settlements.

McClure said city council endeavoured to provide the same level of service for 2016 as it had in 2015 in delivering its status quo budget.

“So no big items (were) cut from the budget, however, some management restructuring has taken place,” he said.

McClure said the NPD has not replaced the deputy chief position but has added a sergeant “which allows for some operational savings.”

The final 2016 tax totals will be known in the next couple of weeks, said McClure.

Budget process

Municipalities in B.C. are required by legislation to have a balanced budget, and the City of Nelson does.

This means that no debt can be incurred to fund the basic operating expenditures. Debt can only be used to fund capital projects, such as buildings, road construction, water, sewer and drainage works.

The budget outlines how the money that comes into the city should be spent to maintain and improve the city.

For more information the regional district’s financial plan may be viewed on the RDCK website .