Lower interest rates, rising incomes more than doubles amount Canadians borrow for a home

Canadians have been able to qualify for much larger mortgages over the past two decades because of declining interest rates and rising incomes, and that has more than likely translated into higher home prices, finds a new study by the Fraser Institute, an independent, non-partisan Canadian public policy think-tank.

“Increased borrowing power, brought about by falling interest rates and rising incomes, is potentially the most overlooked and least understood factor influencing home prices across Canada,” said Niels Veldhuis, president of the Fraser Institute.

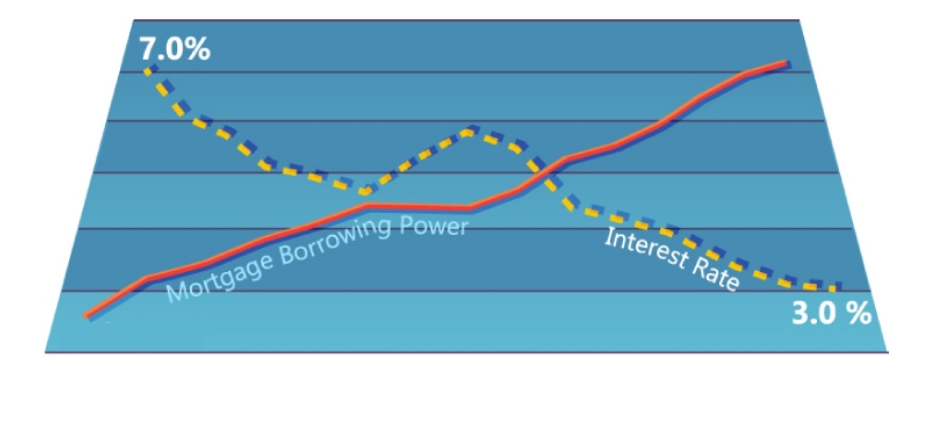

The new study, Interest Rates and Mortgage Borrowing Power in Canada, finds that between 2000 and 2016, interest rates fell from 7.0 to 2.7 per cent, which increased Canadians’ mortgage-borrowing power—the maximum size of mortgage homebuyers can qualify for—by 53 per cent.

Rising incomes across Canada during that same time—also up a nominal 53 per cent nationwide—amplified the increased borrowing power for homebuyers.

Coupled together, the falling interest rates and rising incomes increased Canadians’ mortgage-borrowing power by a staggering 126 per cent.

In major urban areas across Canada, Calgary saw the greatest increase in mortgage-borrowing power at 161 per cent, more than Vancouver (118 per cent), Montreal (115 per cent) and Toronto (100 per cent).

“This increase in borrowing power—in simple terms—means that an average Canadian family, dedicating the same share of their income to monthly mortgage payments, can afford a mortgage that’s more than twice as big now as it would have been in 2000,” Veldhuis said.

The increased capacity to borrow means that homebuyers can bid up the price of homes since the supply of housing is not immediately responsive to changes in demand.

“As would-be homebuyers and governments contend with rising prices across Canada, policy makers should look closely at the impact of interest rates, rising incomes and increased mortgage borrowing power on home prices,” Veldhuis added.